West Virginia Sues Optum and UnitedHealth, Accuses Firms of Fueling Opioid Crisis

West Virginia filed a federal suit on December 8, 2025 accusing UnitedHealth Group and its pharmacy benefit manager Optum of enabling excessive opioid dispensing and evading safeguards that should have limited access. The case raises fresh legal and regulatory pressure on PBMs and insurers, with potential financial and policy implications for how prescription drugs are distributed nationwide.

West Virginia’s attorney general sued UnitedHealth Group and its pharmacy benefit manager Optum on December 8, 2025, alleging the companies exacerbated the state’s opioid epidemic by facilitating widespread and unchecked access to prescription opioids. The federal complaint accuses Optum of prioritizing profit motives over patient safety and circumventing controls that would have curtailed inappropriate dispensing, including through mail order distribution channels that the state says lacked adequate oversight.

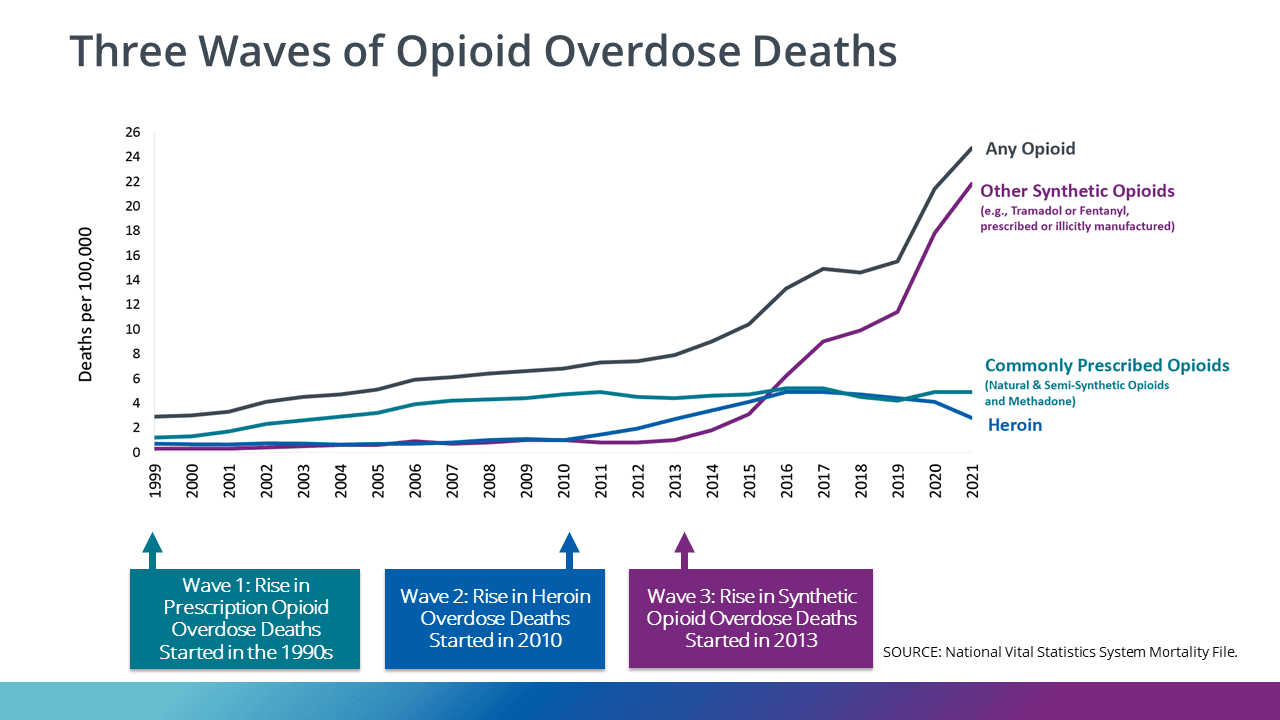

The filing seeks damages and civil remedies, framing the companies as integral actors in a distribution system that failed to identify and stop suspicious prescribing and filling patterns. West Virginia has for years been among the states hardest hit by opioid related harms, and its lawsuit joins a wave of litigation targeting not only manufacturers and distributors but also pharmacy benefit managers, which control formularies, reimbursement rules, and distribution networks for millions of prescriptions.

Optum and UnitedHealth have faced prior litigation over opioids and have disputed similar claims. The state’s complaint underscores a shift in legal strategy by plaintiffs toward intermediaries in the drug supply chain. Pharmacy benefit managers have grown in influence since the early 2000s, consolidating negotiating power and routing more prescription volume through large, centralized operations, including mail order fulfillment that can reduce per unit costs but may complicate clinical oversight.

Economically, the case poses reputational and financial risk for UnitedHealth, one of the largest health insurers and healthcare service companies in the United States. While the complaint does not specify a damages figure, sustained legal exposure could translate into materially higher litigation reserves and pressure on margins for PBM operations, especially if plaintiffs succeed in arguing that commercial incentives tacitly encouraged lax controls. Investors will be watching whether the suit prompts new provisions, settlements, or shifts in business practice that affect revenue from pharmacy services and administrative fees.

Policy ramifications could extend beyond the courtroom. Regulators have increased scrutiny of PBMs in recent years, balancing concerns about drug pricing opacity against the managers’ role in controlling pharmacy networks and drug access. A successful suit could accelerate calls in state legislatures and at the federal level for stricter transparency requirements, tighter monitoring of mail order fulfillment, and clearer standards for detecting and reporting suspicious opioid prescribing.

For states grappling with the long tail of the opioid crisis, litigation offers one avenue to recoup costs for treatment, law enforcement, and social services. It also reflects a broader trend in public policy toward holding intermediaries accountable for how market structures shape public health outcomes. As the case proceeds in federal court, it will test legal theories that seek to attribute community level harms to commercial practices in complex pharmaceutical supply chains, and it could influence how insurers and PBMs structure distribution and oversight to mitigate both clinical risk and legal liability.