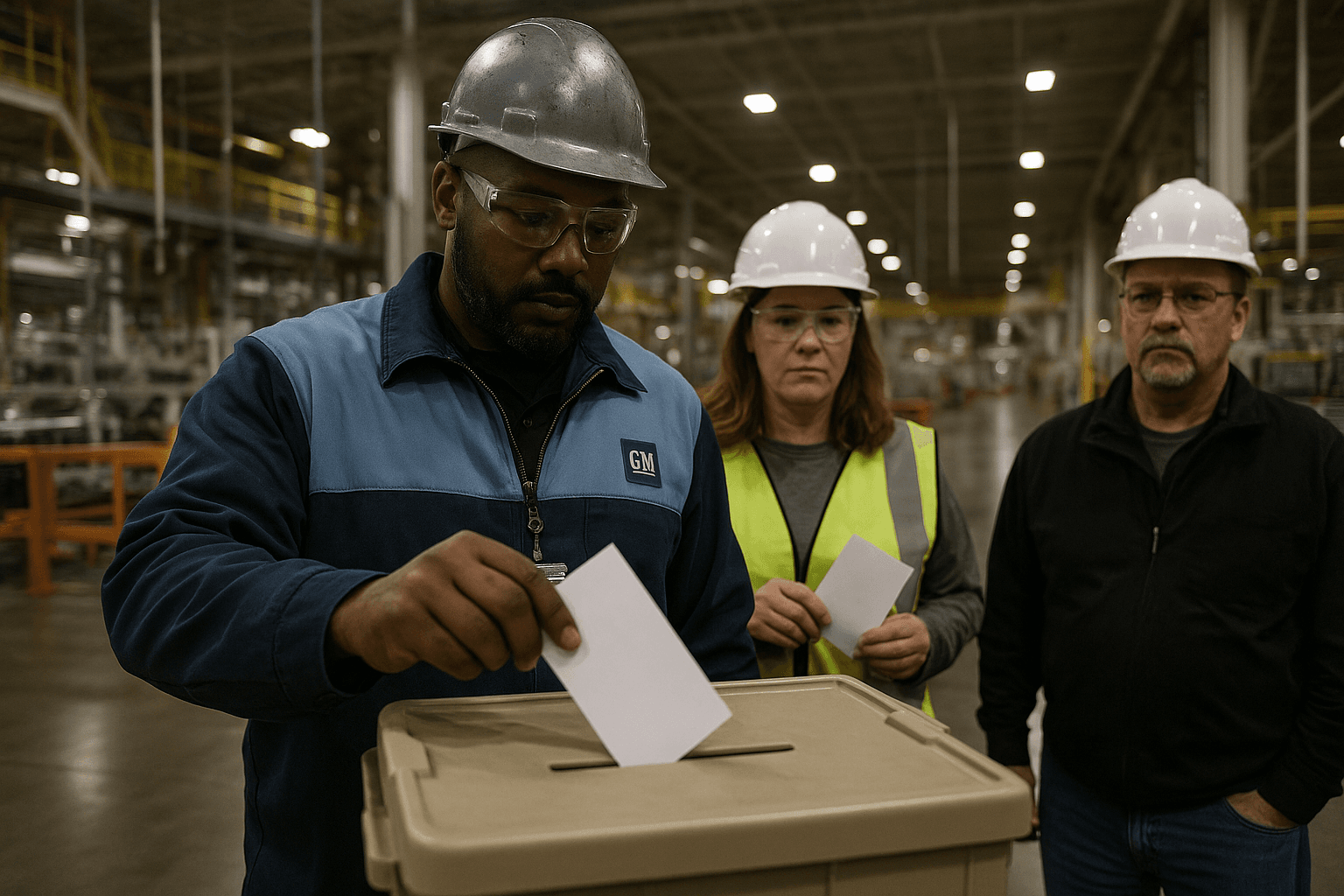

Workers Finish Vote on Unionization at GM, LG Battery Plant

Employees at the General Motors and LG Energy joint venture battery cell plant in Ohio are completing a union vote this week, a result that could be certified within 24 hours of polls closing and reshape bargaining dynamics across the electric vehicle supply chain. The outcome matters to millions of EV buyers and investors because it could increase labor leverage over where automakers invest in battery capacity, and influence costs, plant siting, and the pace of the EV transition.

Workers at the GM LG Energy joint venture battery cell plant in Ohio are completing a ballot count this week in a vote that could be certified within 24 hours of polls closing. The election comes as the United Auto Workers presses to extend its recent organizing momentum into the electric vehicle supply chain, targeting key battery production sites that underpin automakers plans for EV expansion.

Under local vote procedures, plant employees cast ballots at a regional polling location, with results expected to be tallied rapidly and certified if they meet the required thresholds. A successful union drive would give the UAW a formal voice at a strategic node in the EV production chain, potentially altering negotiations over wages, workplace rules, and capital deployment. A defeat would likely force labor to reconsider tactics as it seeks to maintain momentum in an industry undergoing rapid technological change.

The stakes are tangible. Battery cell manufacturing is capital intensive, with single facilities often representing multibillion dollar investments and supplying the cells that determine vehicle range and cost. If organized labor secures representation at this plant, automakers and suppliers may factor collective bargaining terms into future siting and investment decisions. That could affect where future gigafactories are built, the pace of capacity expansion, and ultimately the unit cost of batteries, a key driver of EV affordability.

Investors will be watching for market signals. Labor gains at critical battery sites could be interpreted as a potential source of higher production costs or scheduling uncertainty for companies dependent on those plants. Conversely, failure of the union drive could ease concerns about labor disruptions but might also prompt unions to shift focus to different leverage points, such as supplier networks or joint ventures elsewhere.

The broader context includes recent high profile labor campaigns by the UAW that delivered wage increases and changes in work rules for traditional auto manufacturing. The union is now translating those efforts into a campaign aimed at the upstream components of EV manufacturing, reflecting a long term strategy to influence the economics of electrification. Policymakers are also implicated, because federal incentives for domestic clean energy and EV production increase the value of U.S based battery capacity, making control over that capacity more consequential for local economies.

Local leaders and industry watchers say the outcome could reverberate beyond the plant. Labor organization at battery sites could give unions leverage over corporate investment plans and prompt a reappraisal of risk by firms weighing new plants. That could, in turn, reshape regional job prospects tied to clean energy manufacturing and influence how quickly automakers can scale EV output to meet consumer demand and regulatory targets.

The vote is a test of how labor and industry will coexist in the transition to electric mobility. Results certified in the coming day will offer an early indication of whether unions can translate recent gains into sustained influence over the supply chain that will define the future of the U.S auto industry.